Here’s A Quick Way To Solve A Tips About How To Afford Mortgage

Explore what you may afford question 1 what is your yearly.

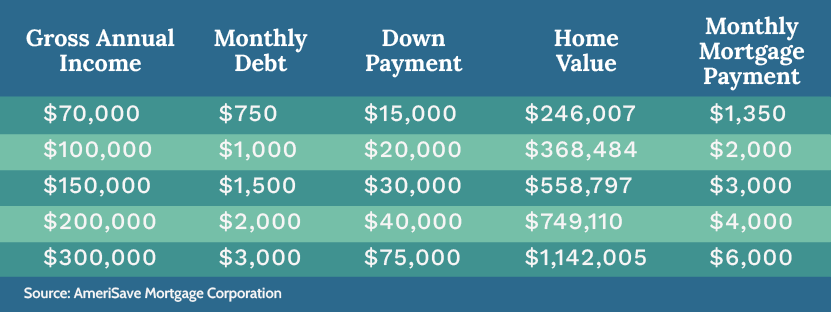

How to afford mortgage. Ad more veterans than ever are buying with $0 down. The home affordability calculator will give you a rough estimation of how much home can i afford if i make $120,000 a year. Using a percentage of your income can help determine how much house you can afford.

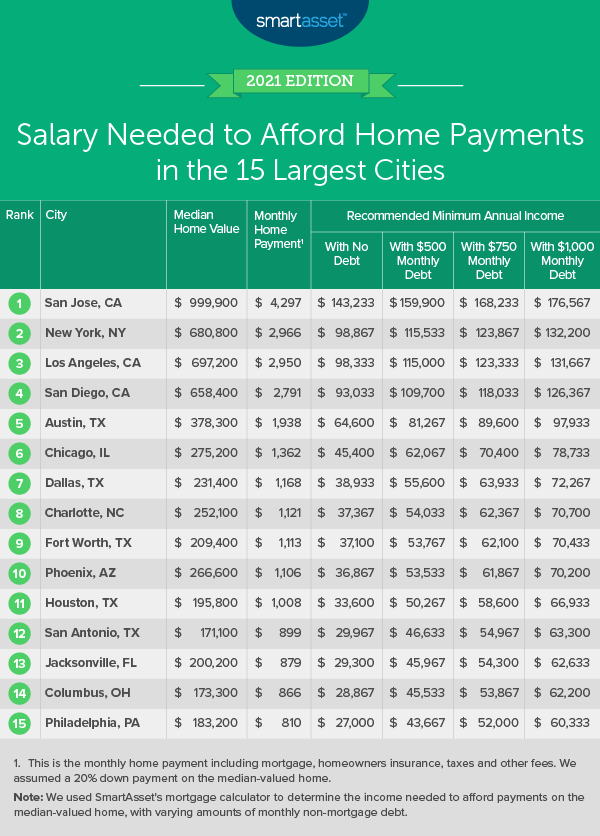

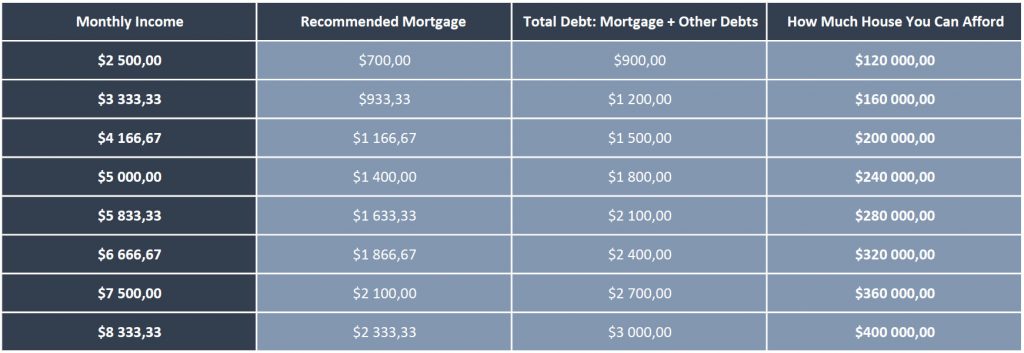

So if you bring home $5,000 per month (before taxes), your monthly mortgage payment should be no more than $1,400. Ad compare mortgage options & calculate payments. How lenders determine what you can afford.

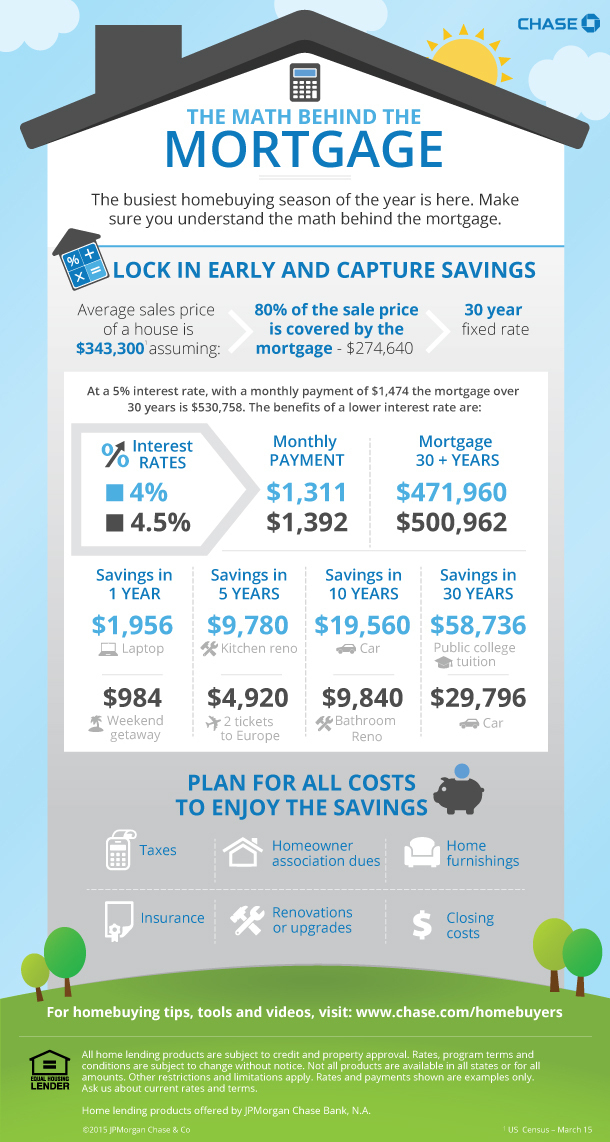

Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. The 28%/36% rule is a general guideline that lenders use to determine how much house you can afford. Lock your mortgage rate today!

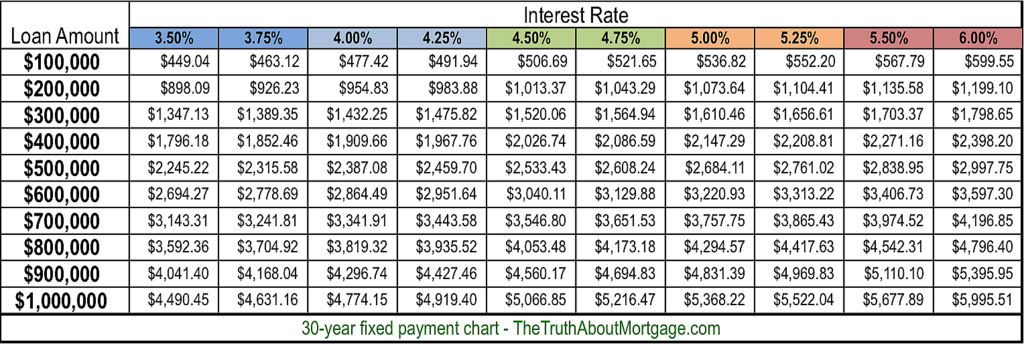

The decision to buy a home should be based on the following factors, which can affect your ability to afford the monthly mortgage payment on your salary. Using a $300,000 mortgage, here’s an example: Know your income for most nigerians, buying a house is very likely to be the most significant purchase they would.

The fha helps people get a mortgage by requiring less money down than what's usually required with conventional loans. Generally speaking, no more than 25% to 28% of your monthly income should go toward your mortgage payment, according to freddie mac. This is the total amount of money earned for the year before taxes and other deductions.

To afford the median monthly mortgage payment of $3,424, people here would have to work an average. Begin your loan search right here. Explore the lowest rates online.