Awe-Inspiring Examples Of Info About How To Avoid The Marriage Penalty

The only way to avoid it would be to file as single, but if you’re married, you can’t do that.

How to avoid the marriage penalty. Not every married couple has to pay a penalty. And while there's no penalty for the married filing separately tax status, filing separately. The only way to avoid it would be to file as single, but if you're married, you can't do that.

The good news is there is not a marriage penalty when you sell your home. “it’s a workaround for the. The only way to avoid it would be to file as single, but if you’re married, you can’t do that.

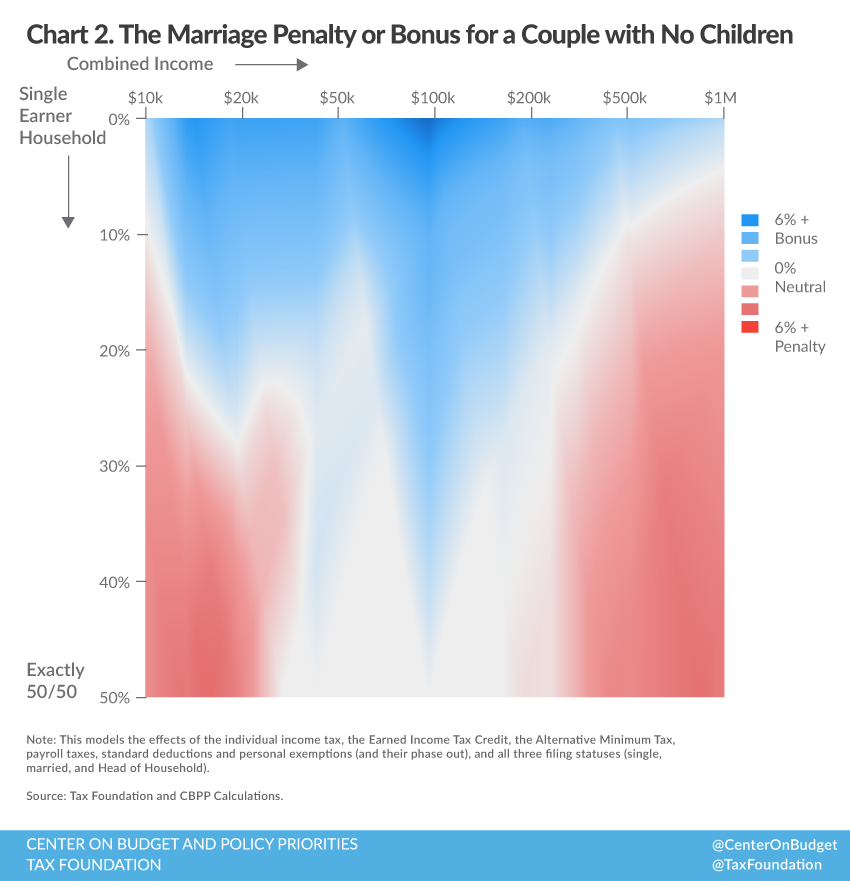

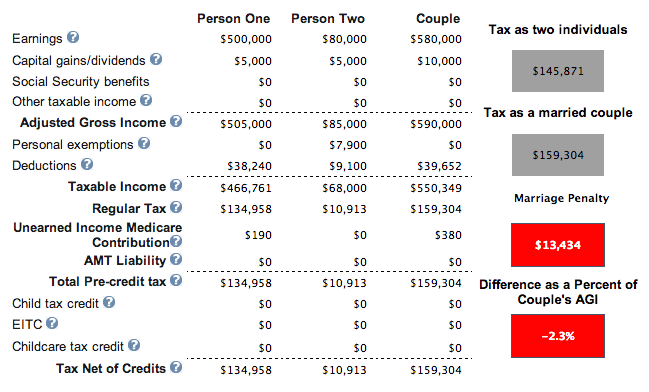

Before the “tax cuts and jobs act”, which took effect in 2018, many taxpayers faced higher federal and state tax bills after marriage (beebe, 2019). To avoid a marriage penalty, the tax bracket income thresholds for married couples must be exactly double those for single taxpayers. If that is the case, i would hope that income affords you the ability to marry your spouse.

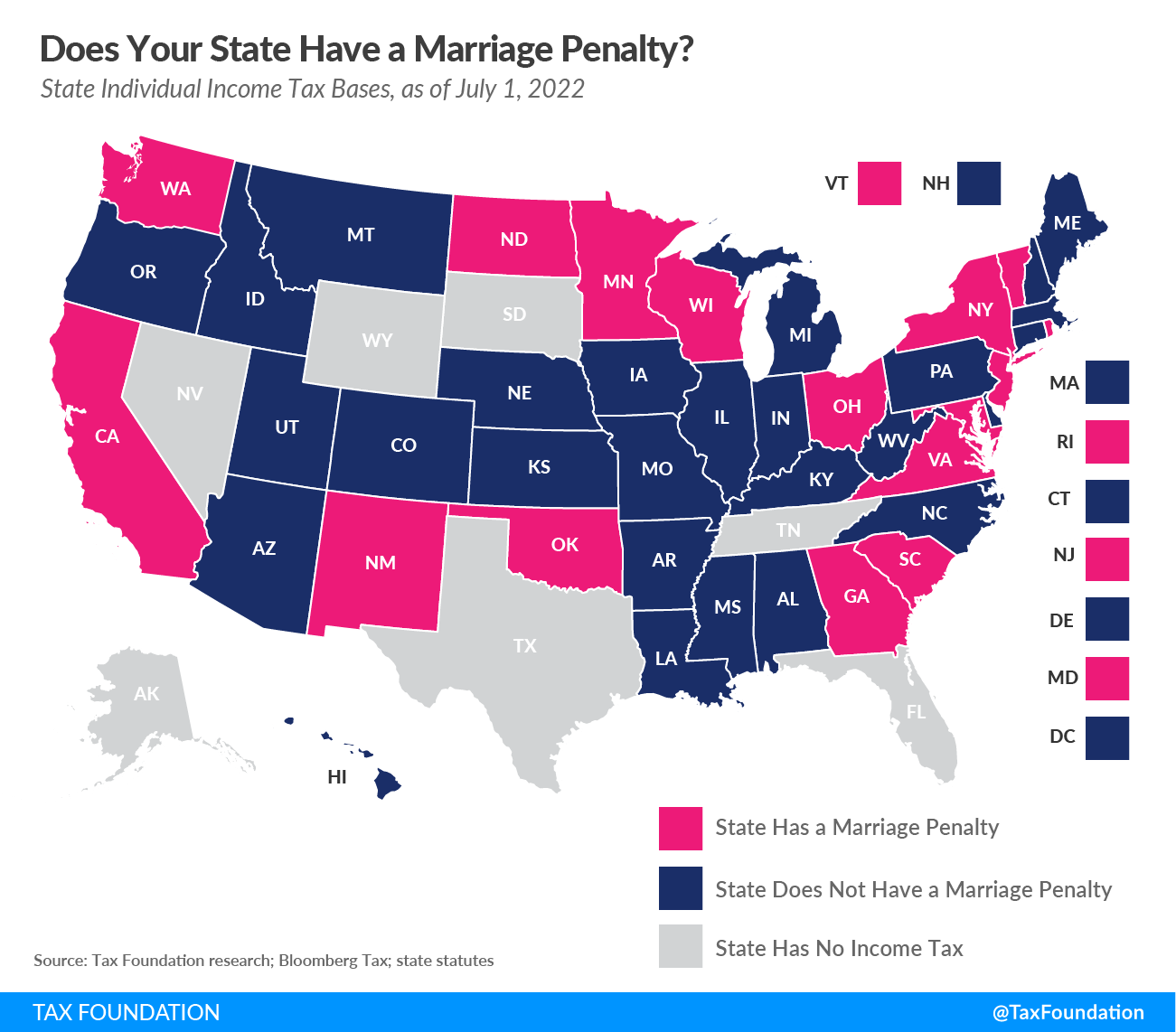

The marriage penalty stems from the federal tax brackets. And while there’s no penalty for the married filing separately tax status, filing. Seven additional states (arkansas, delaware, iowa, mississippi, missouri, montana, and west virginia), as well as the district of columbia, offset the marriage penalty in their bracket.

It did this by making most of the married filing jointly tax brackets. For one thing, married couples who choose not to file together do not file individual returns. According to the tax foundation, spouses who file jointly can enjoy a 20% bonus on their combined marital income if they have.

Instead, they file married filing separately. The marriage penalty tax, however, may still apply when a married couple's income exceeds the 15% tax bracket. The marriage tax penalty or marriage bonus is something couples should.