Unique Tips About How To Find Out If Your Tax Return Will Be Taken

Check your tax withholding with the irs tax withholding estimator, a tool that helps ensure you have the right amount of tax withheld from your paycheck.

How to find out if your tax return will be taken. One big part of the income tax formula comes from the information you give to your employer when you start your job. You can estimate the amount of this year’s. To verify your identify, you'll need.

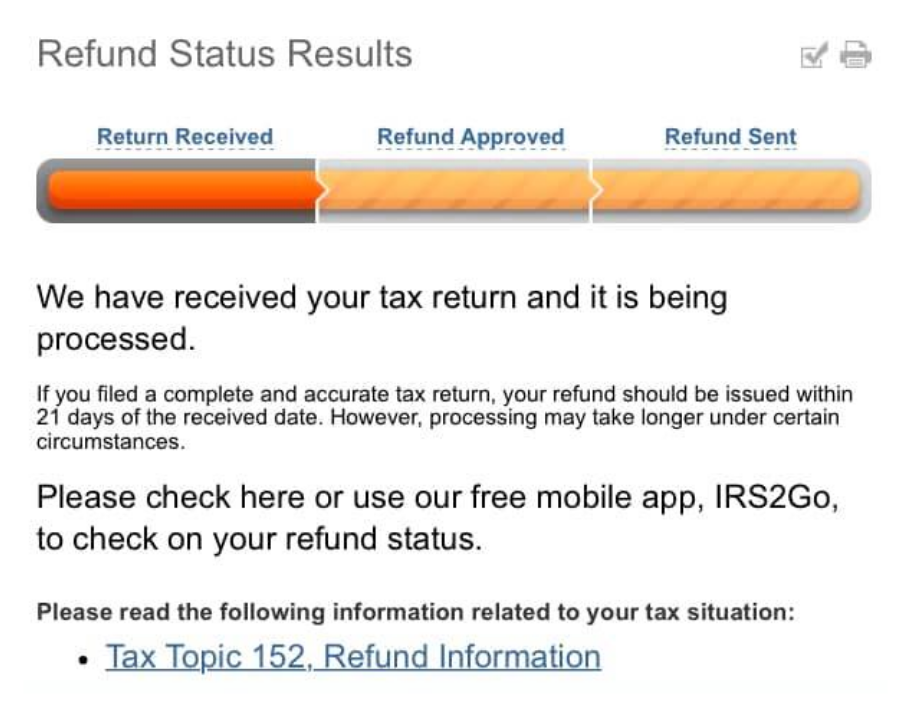

Your household income, location, filing status and. Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: When it’s time to file, have your tax refund direct deposited with credit karma money™, and you could receive your funds up to 5 days early.

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: Send your tax return by the deadline. You’ll need your most recent pay stubs and income tax return.

Ad learn about the common reasons for a tax refund delay and what to do next. The amount of tax you will get back in this year’s refund depends on factors such as your income, number of dependents and type of deduction. Your filing status your exact refund amount check my refund status where’s my refund?

Locating a refund if you filed a tax return and are expecting a refund from the irs, you may want to find out the status of the refund, or at least get an idea of when you might. Tap on the profile icon to edityour financial details. On the first day at most jobs, you must fill out a form w.

Check your refund status by phone before you call. Yes, if you need to know whether your federal tax refund check was cashed, you can initiate a refund trace by using one of the following methods: Check for the latest updates and resources throughout the tax season