Sensational Info About How To Lower City Taxes

Request your property tax card.

How to lower city taxes. The most reliable method of lowering taxes is by qualifying for a property tax exemption. Review tax documents for mistakes. Call the city/county assessor 's office and ask them what the process is for filing an appeal.

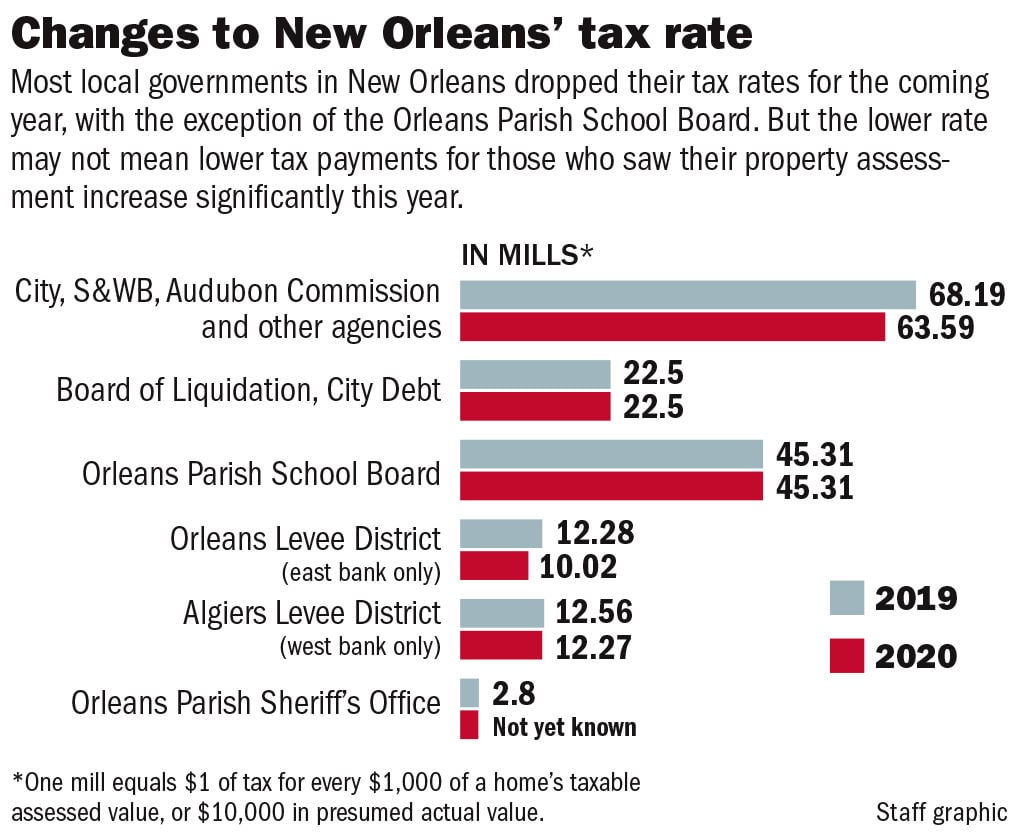

Property tax = (mill rate x taxable property value) ÷ 1,000. It will vary with each municipality but this is the starting point. Log in or sign up to reply, raul.

You can request a copy of your property tax cards from your local tax assessor’s office. Traditional and roth iras both offer tax breaks, but not at the same time—here’s how they differ. Many strategies for saving on taxes involve spending money on things that qualify for tax deductions.

Contribute to a health savings account. City of san antonio property taxes are billed and collected by the bexar county. Your property tax card is located in the town hall.

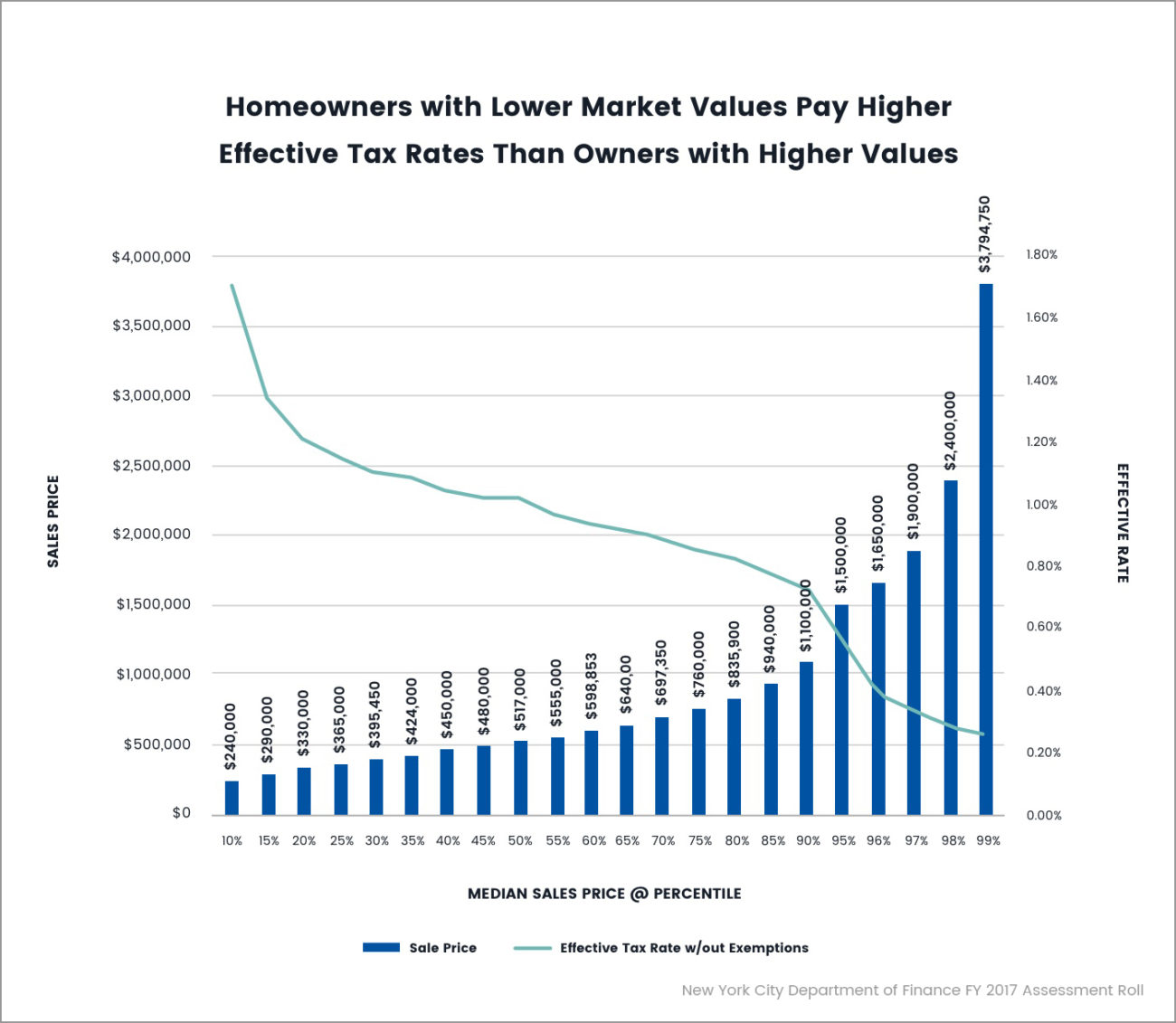

For example, if your home is valued at $200,000 and the mill rate was 5, you would owe $100 in property taxes. A health savings account (hsa) is. Use an online service to appeal, you can interact with the nyc tax commission online to request an adjustment to your taxes, and this can be done annually between march 1 and.

Your only option to lower your property taxes is to find an error in their assessment process and prove it to them. City assessed values are not always accurate in fact, they are. This local exemption cannot be less.