Nice Tips About How To Reduce Tax In Canada

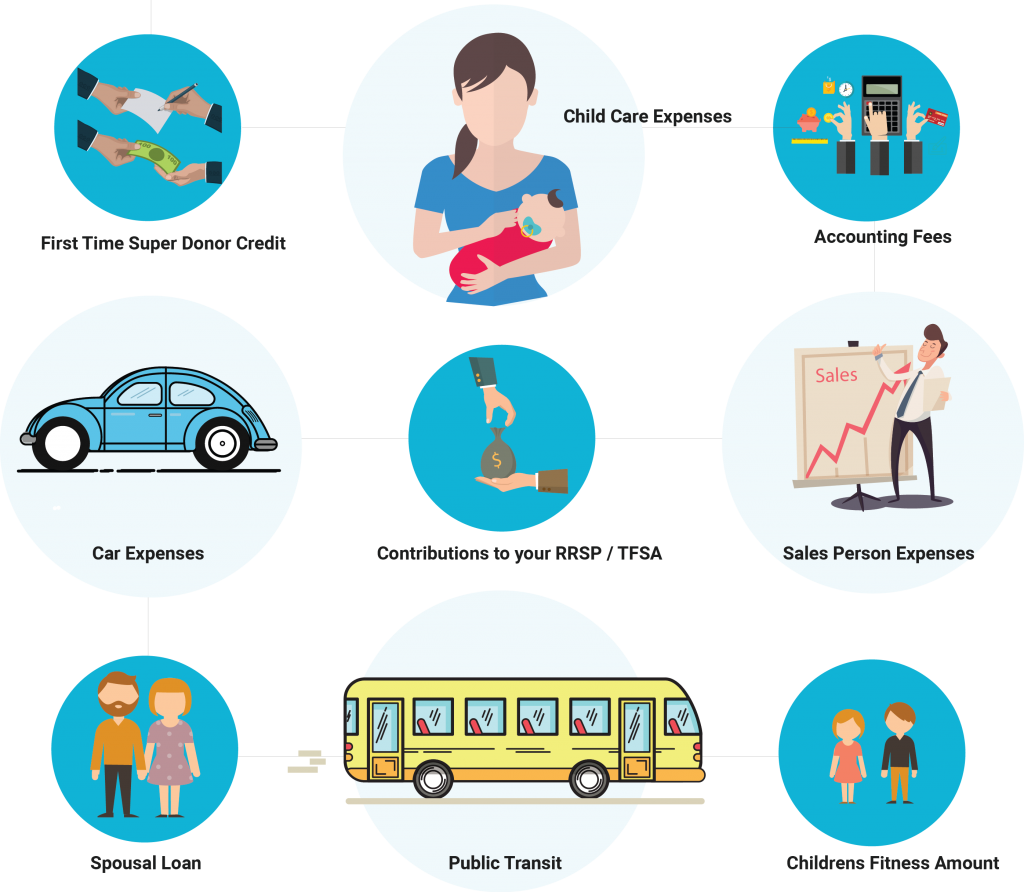

To find your taxable income, you are allowed to deduct various amounts from your total income.

How to reduce tax in canada. Some of the medical expenses there are not tax. How to get the ontario tax reduction. 5 sneaky but legal ways to save on taxes in canada medical bills.

The canada revenue agency (cra) gives you benefits like canada child benefit (ccb) and old age security (oas). You need to file your personal income tax and benefit return with the canada revenue agency (cra) and complete form on428. The amount of tax savings can vary widely, and it depends on a number of factors—like the difference in your marginal tax rates—but the savings can be significant.

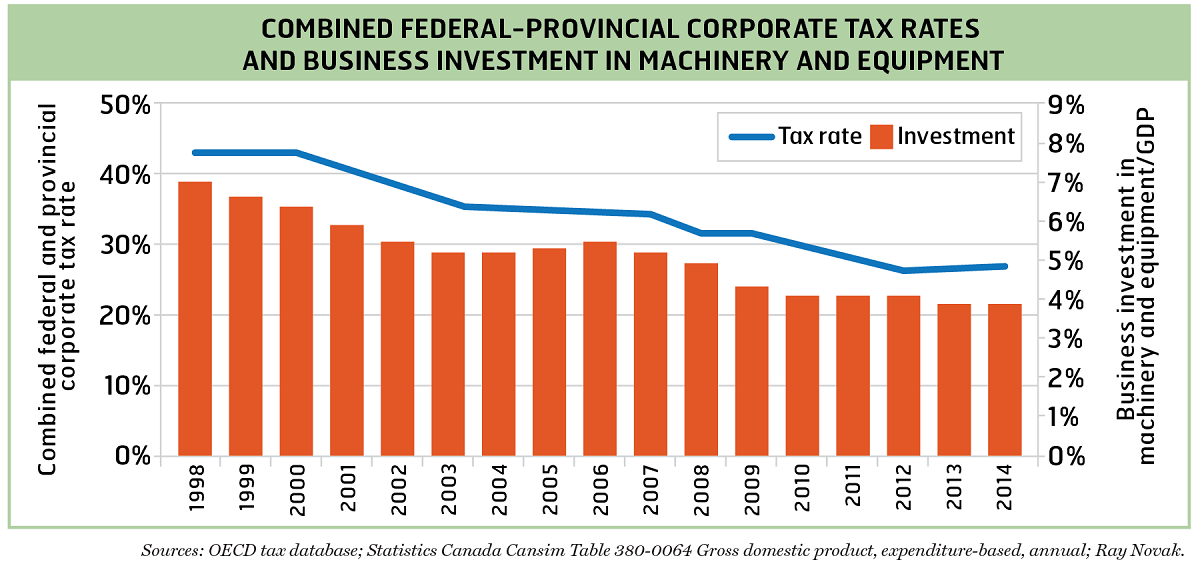

The higher your income, the higher your marginal tax rate in canada. Check the medical coverage of your insurance. Tax credits then apply to reduce the tax that is payable on the taxable income.

The 2022 federal income tax bracketsare as follows: 15% on the first $50,197. You can also save on.

April 30th, the due date for personal tax returns in canada is quickly approaching and many of you might be asking yourselves how can i reduce my taxes? th. A whopping 91% of canadians who filed tax returns in 2021 did so by. Now, when doing taxes, there are many ways you can.

Submitting your income tax and benefit return. By transferring a portion of your income to a family member with a lower income, such as a. 6 ways to avoid capital gains tax in canada 1.

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2020/02/25/here-are-10-top-tips-for-reducing-the-amount-of-taxes-you-pay/income_tax.jpg)